Thought Leadership

Off The Pitch Column: Chelsea – A takeover like no other

13 MIN READ

Thought Leadership

Inspired by what you’re reading? Why not subscribe for regular insights delivered straight to your inbox.

The Chelsea takeover has been one of a kind. The reason for the sale, the hurried nature of the sales process, the UK government involvement, the ensuing bidding war between multi-billion pound investment groups – we may never see a more remarkable sports club transaction.

News has recently broken that Roman Abramovich and the UK government have finally struck a deal that will allow the transaction to move forward. The consortium led by American and Los Angeles Dodgers, Sparks, and Lakers owner Todd Boehly is just a few dotted i’s and crossed t’s away from completing the most expensive takeover in football history. The final price tag is reportedly just over £4.25bn – two billion more than when Boehly made a pre-pandemic offer at the end of 2019.

Supporters have massively benefited both from Roman Abramovich’s decision to not seek repayment of the club’s debt to Fordstam Ltd and from The Raine Group’s competitive bidding process. In addition to having already been at the table for the club, the new consortium brought a competitive advantage in their commitment to invest an additional £1.75bn into Stamford Bridge, the women’s team, the academy, Kingsmeadow, and the Chelsea Foundation.

The football club itself is selling for £2.5bn.

Club Valuation – Is Boehly overpaying?

Twenty First Group’s valuation model puts Chelsea at a £2bn football club, suggesting that Boehly and his group are paying a half-billion pound premium to call West London home.

Despite all the headlines and obvious appeal, the Blues are currently not even the most valuable club in London. However, this consortium of seasoned investors believes the significant extra cost is worth the opportunity to own one of the most unique sports clubs in the world. Their success will hinge on their capacity to swing Abramovich’s former club towards profitability while maintaining Chelsea’s existing sporting strengths.

Without a doubt, Chelsea is a rare football club with attractive fundamentals. The club has a strong performance outlook, a highly productive academy, a glamorous postal code, and a growing global brand that is the envy of most clubs in the world. Any club with these criteria can credibly demand a significant premium.

Considering the above, you would perhaps think that Chelsea should be valued considerably higher than £2bn. But hurting the club’s overall valuation are a couple operational red flags that Boehly’s group must quickly address if they’re interested in a successful stewardship of the club.

Firstly, a reliance on Abramovich’s deep pockets has led to Chelsea’s systematic heavy transfer spend and operating losses; thankfully, the club is at least moderately efficient in their capacity to spend on player wages. And secondly, the Blues have some real limitations on future revenue growth, compounded by the fact much of football is still recovering from the disruption of the Covid pandemic.

While European football is a different beast to North American sports, Boehly can at least tout genuine experience with turning around a historic franchise in another of the world’s major cities with the LA Dodgers and with operating at the pinnacle of glitz and glamour in sport with the LA Lakers. The group is betting big on the belief they can now do the same in West London and operate Chelsea like a business.

Performance Outlook

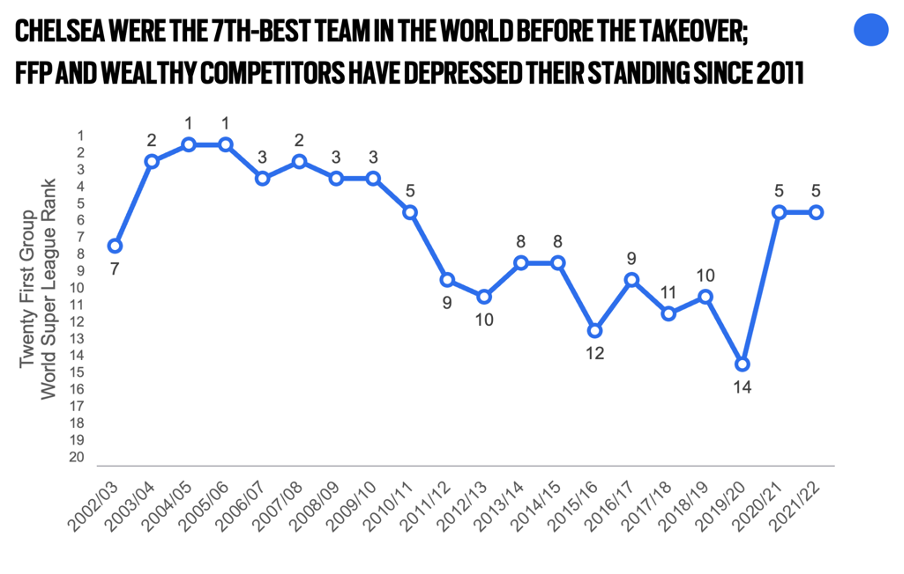

Chelsea sit in a uniquely comfortable position within the highly competitive Premier League. They have been the fifth best club in the world the last two seasons and have been comfortably the third strongest team in the Premier League. While a reasonable distance from the top two (Chelsea have finished below Manchester City and Liverpool in each of the last five seasons), the club are a clear “best of the rest”.

Chelsea’s current performance level translates to a 13% steady-state probability of winning the league, but a 73% chance of Champions League qualification and 18% chance of Europa League qualification. And of course the Blues are part of a small subset of European clubs where the risk of top-flight relegation is of no concern.

Provided they are able to continue the winning culture currently at Stamford Bridge, Boehly et al will enjoy almost as much “closed European Super League” comfort as is possible in the football world today.

Typically, there are two ways an owner can improve their club: spend more and spend better.

Unfortunately for most owners of English football clubs, the country’s competitive environment is far from financially efficient compared to other leagues in the world – putting the group’s goal of profitable operations at a clear disadvantage from the start.

Over the last five years, less than 20% of men’s football clubs playing at least one season in the Premier League have performed better on the pitch than clubs around the world with comparable wage bills. For example, Everton’s wage bill has tended to have been in the top 20 clubs in the world, but according to our World Super League model their performance has consistently been outside the top 40.

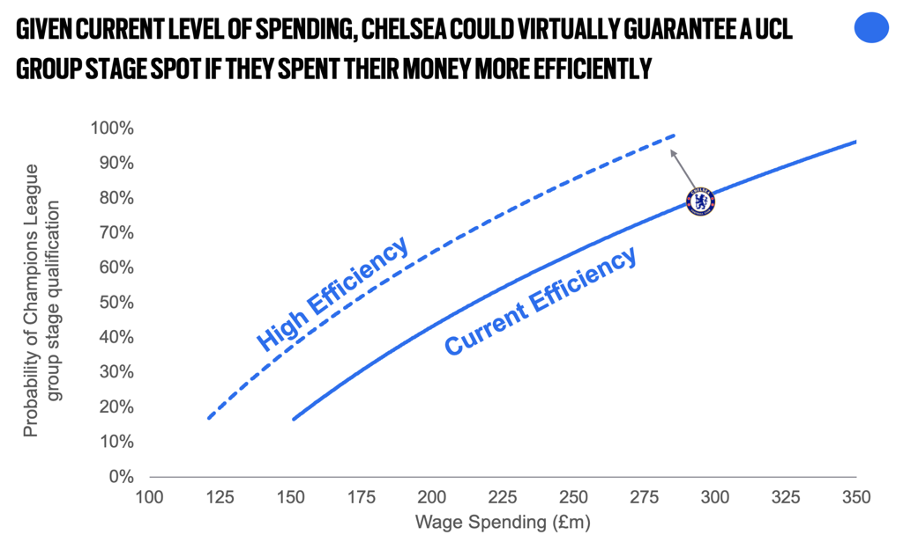

Twenty First Group’s club spending analysis places Chelsea’s last five years at just under the 60th percentile of wage efficiency relative to the already inefficient English market. And of the “Big Six” Premier League clubs, Chelsea is the fourth best at turning their spend into on-pitch performance – behind Manchester City, Liverpool, and Tottenham.

A significant factor for Boehly’s group having success will be improving the efficiency with which the club can secure results. The club already spends enough on wages that the club could virtually guarantee a Champions League group stage qualification, even by reducing their wage bill, if they spent their money as well as the more efficient clubs in England.

One area the club may choose to lean into to increase wage-efficiency is their proven capacity to produce high quality talent, as younger players typically demand lower wages. Only Manchester United have developed more Premier League players than Chelsea. And the club’s most recent coaches (Thomas Tuchel and Frank Lampard) have both shown a willingness to embrace and cultivate an environment within the club that is willing to give valuable minutes to deserving academy products.

Profligate Spending

Despite the club’s ability to perform relatively ‘as expected’ on the pitch relative to wages, Roman Abramovich’s Chelsea has still managed to burn through cash like few others in recent decades.

In the last 10 years, Chelsea have sustained over £750m in operating losses, over a quarter-billion more than any other “Big Six” club. Yes, Covid has negatively impacted them as it has all other football clubs. But even prior to the pandemic, Chelsea were averaging close to £70m in annual operating losses.

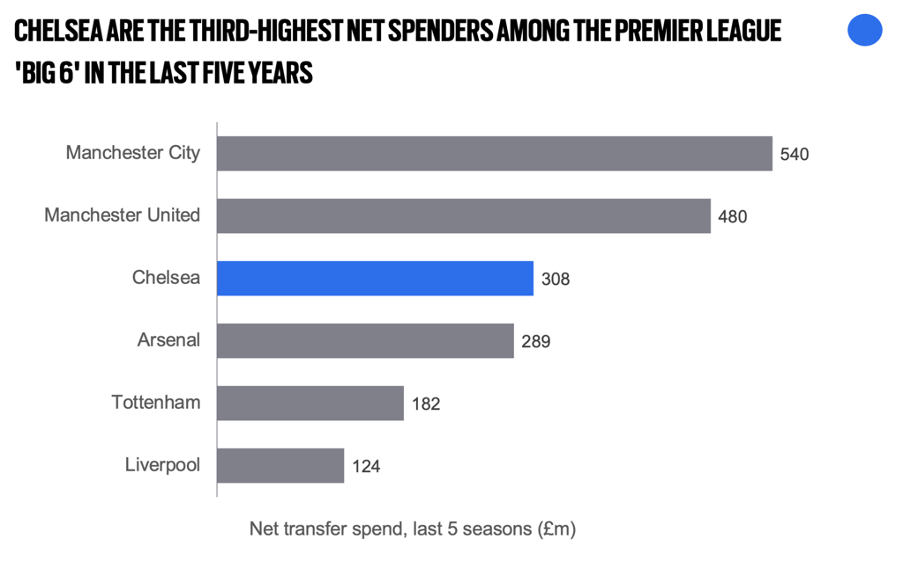

While Chelsea have managed to keep their first-team wage bill financially efficient, the club’s dealing in the transfer market is an expensive habit. Spending £308m more on player inflows than outflows over the last five seasons, Chelsea are amongst three Premier League clubs with the largest net spend in the transfer market.

It is safe to assume that Boehly’s group won’t want to bankroll the same indulgent spending Abramovich has over the last two decades without a more financially sustainable practice in place. This will be a big organisational challenge to navigate in the coming years, particularly if the group are looking to maintain their current rosy performance outlook.

Revenue Generation

Necessity is the mother of innovation. Unfortunately for Chelsea’s new owners, the club has not had that necessity under Abramovich. The new ownership consortium will need to bring (or hire) some serious firepower to help the club unlock new means of revenue generation

Despite their strong on-pitch performance, Chelsea has not been a top-three revenue-producing club in England since 2014. Their capacity for revenue generation is low relative to their spending habits, making any transition to a financial sustainable model even more difficult.

Coming off a Champions League triumph last season, Chelsea’s actual broadcast revenue distributions are about as high as their expected share of broadcast revenue could ever be. The club has earned more money from European Competition over the last decade than any other English club except for Manchester City.

While other clubs may look to stronger on-field performance as a means to boost broadcast revenues, Chelsea have little room for growth in this area. The club will need to maintain their recent high standard of sporting performance otherwise they face a risk of these revenues declining (see: AS Roma and Manchester United). Without an expectation in future seasons for Chelsea to perform better domestically than currently, and with the club’s steady-state chance of UCL qualification at 64%, Boehly and his group will need to rely on future media rights value growth to grow their broadcast revenues.

Another core driver for low revenue generation has been that since 2014, Chelsea has witnessed some of the lowest commercial revenue growth of the “Big Six”. The last eight years have seen the club nearly tie Manchester United for the smallest absolute growth in commercial revenues, who began with a 73% higher base and have been a weaker team.

Lastly, having not redeveloped Stamford Bridge, the club has stagnated in their matchday revenues this decade (ignoring the pandemic) while other clubs have been growing their revenues and building for the future. While matchday revenue makes up a minority of the club’s income, it can prove to be important at the margins especially during times of poorer sports performance (again, see: Manchester United). Boehly’s group will feel these constraints exacerbated for years to come while several of their London neighbours (Tottenham, Brentford, Fulham, Crystal Palace) begin to realise the full benefits of their stadium improvements.

Conclusion

There is unlikely to be a more unique and high profile football takeover anytime soon as Chelsea’s. With a preferred bidder named and the UK government reportedly blessing the transaction, the club can hopefully look to the future and move on from the recent controversy, uncertainty, and operational threats they have been faced with.

Boehly and his group have a prized asset in Chelsea and have certainly paid for it. Now can they help the club develop sustainability off the pitch while matching the performance on the pitch that they have enjoyed in recent times?

If you would like to find out more about Twenty First Group’s Investment Intelligence services, please get in touch with AJ Swoboda.

You can read an example of our investment intelligence work here.

This article was originally published by Off The Pitch.